Trade used to be the biggest source of friction between the United States and Japan. But trade is now emerging as concern that binds the world’s biggest and third-largest economies. As shared concerns about supply chain resiliency and over-dependence on China increase, the two countries have concluded a trade deal signed to bolster the supply chain of critical minerals for both by preventing either side from imposing export duties on lithium, cobalt, nickel, graphite, and manganese on the other. That, in turn, will allow the United States and Japan to work together to push back against China dominating the electric vehicle battery sector. The longer-term political significance of the deal that is enhancing U.S. relations with Japan, however, cannot be underestimated.

First, it demonstrates the Biden administration’s willingness to work together with key allies on the trade front. While the White House has enhanced coordination efforts on security in the Indo-Pacific, its trade policies have been seen as more in line with that of the Trump administrations and increasingly protectionist. In particular, the Inflation Reduction Act’s stipulation that tax credits would only be available in sourcing parts and materials from countries that the United States has a free trade agreement had concerned Japan and the European Union. Neither Tokyo nor Brussels have a comprehensive FTA with the United States, and whilst the IRA is an effort by the Biden administration to bolster the US clean energy industry, both Japan and Europe had made clear their concerns about being blocked out of tax credits that would be provided by the IRA. The latest deal ensures that materials processed in Japan too will qualify for IRA tax breaks, with US Trade Representative Katherine Tai noting that Japan is “one of our most valued trading partners.”

Secondly, trade relations between Japan and the United States are no longer defined by addressing trade imbalances and pressing for market access. At the same time, countries have focused more on averting being hit by the protectionist measures by Washington as the United States focuses on boosting greater domestic resilience and the competitiveness of its own companies. With little political appetite in Washington for signing on to new trade deals, US partners without FTAs have been looking to find common ground with Washington to forge a new way forward to develop trade relations with the United States. Managing supply chain disruptions has emerged as a key issue of mutual interest for Japan as well as the United States, and both countries have identified critical minerals and large capacity batteries as key areas that require not only greater domestic investments, but also “friendshoring” among trusted partner countries to boost resilience to disruptions.

The latest deal ensures that materials processed in Japan too will qualify for IRA tax breaks, with US Trade Representative Katherine Tai noting that Japan is “one of our most valued trading partners.”

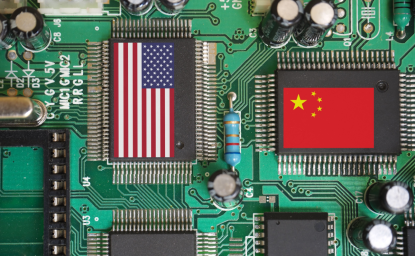

Thirdly, while China is the single largest trading partner for Japan as well as for the rest of Asia, a consensus about China as an economic threat is clearly emerging. Keeping away advanced technology from China and curtailing Beijing’s emergence as a technology competitor is a foreign policy objective that has bipartisan support on Capitol Hill, and a goal that is increasingly shared by US allies as well. Earlier this year, the United States, Japan, and the Netherlands signed an agreement to restrict exports of advanced chipmaking machinery to China, following the unilateral US decision to impose export controls on advanced semiconductor technology. The latest critical minerals supply chain deal between the United States and Japan builds on those endeavors. The deal furthers bilateral efforts not just to hedge against unexpected disruptions for the electric vehicle battery industry, but to confront Chinese economic coercion and Beijing’s manipulation of its dominance in critical minerals that could be weaponized against its foes.

As Japan prepares to host the G7 summit meeting in May, Prime Minister Fumio Kishida is expected to advance efforts for greater cooperation amongst the world’s richest nations to push back against Chinese economic coercion that goes beyond leveraging its dominance in the critical minerals sector. From keeping away advanced semiconductor technology from Beijing to decreasing dependence on China in critical industries, a larger network of like-minded countries united in staving off Chinese coercion by reorienting supply chains is expected to advance further.

Author

Indo-Pacific Program

The Indo-Pacific Program promotes policy debate and intellectual discussions on US interests in the Asia-Pacific as well as political, economic, security, and social issues relating to the world’s most populous and economically dynamic region. Read more

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more